Description: 32 acre “distressed” infill site.

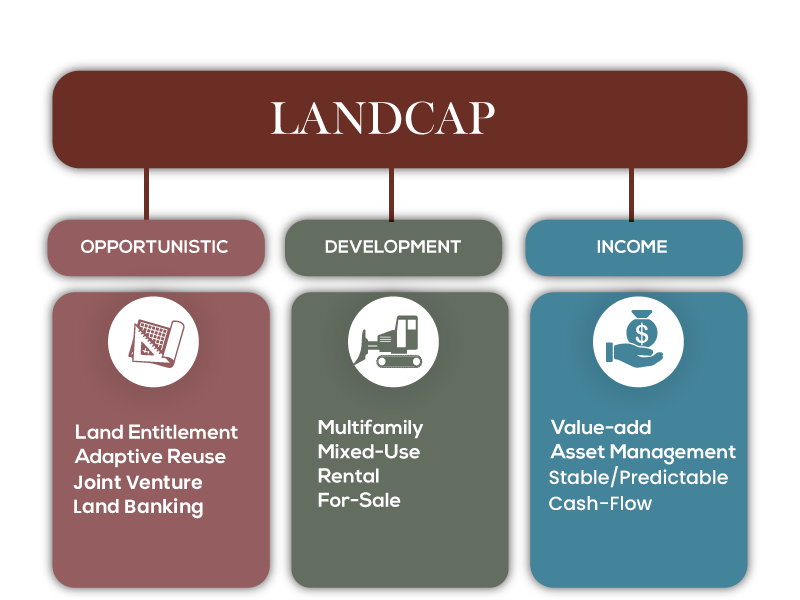

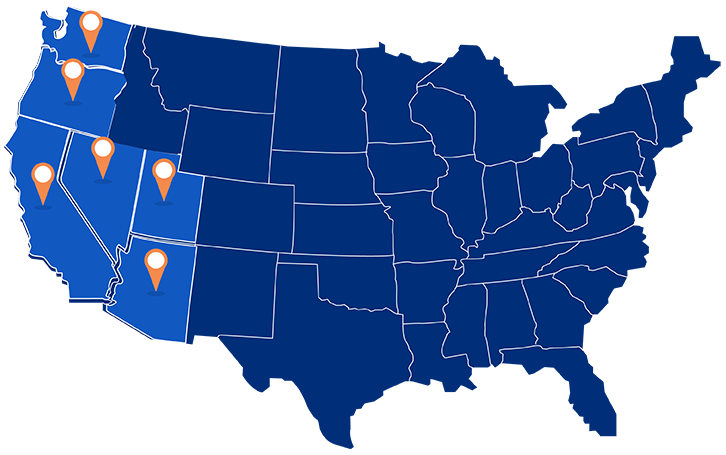

LandCap Investment Partners is a private real estate investment firm committed to generating attractive risk adjusted returns through Reimagining & Revitalizing Communities across the Western United States.

LandCap Investment Partners is a private real estate investment firm committed to generating attractive risk adjusted returns through Reimagining & Revitalizing Communities across the Western United States. LandCap Investment Partners is a private real estate investment firm committed to generating attractive risk adjusted returns through Reimagining & Revitalizing Communities across the Western United States.

LandCap Investment Partners is a private real estate investment firm committed to generating attractive risk adjusted returns through Reimagining & Revitalizing Communities across the Western United States.US Western States Focus

Institutional Execution

Entrepreneurial Spirit

Exceptional Performance

About LandCap

Founded in 2010, LandCap started as a real estate investment firm focused on distressed land & redevelopment mixed use assets. Since its founding the firm has made 19 acquisitions to date & has successfully exited multiple projects providing significant investor returns through a proactive value-add approach including entitlement, re-entitlement & development. Today, LandCap continues to invest along its opportunistic focus & has expanded into investing & managing income properties including: In-fill residential, mixed-use, commercial & retail.

PROACTIVE VALUE-CREATION: LandCap believes that at this stage in the real estate cycle it is mandatory that a manager create value rather than rely on market growth. LandCap has a dedicated investment and shareholder value creation strategy focusing on real estate fundamentals and a diverse set of value-add opportunities. Through investing across our three verticals we provide a unique combination of stable cash flow, downside protection, and potential for capital appreciation.

Founders

Steve Hinckley

Founder

CEO

Chair of Investment Committee

Shinckley@LandCapIP.com

Over 40 years of experience in the real estate industry as an entrepreneur, corporate lender, mortgage banker, private equity and private investor.

Previously:

* Senior Managing Director of KeyBank Private Equity Group, investing over $400 million of equity and mezzanine capital with a total project value of $3 billion.

* Founded Centre Trust Advisors / CTA Capital Partners, primarily focused on housing sector investments.

* Founder of two mortgage banking firms. C Level management experience.

Jeffrey Holbrook

Founder

COO

Member of Investment Committee

Jholbrook@LandCapIP.com

Over 35 years of experience in real estate as an investor, developer, and builder.

Previously:

* Founded Jeffrey Homes, which entitled, developed and built nearly 1,000 housing units.

* As COO & CFO, Jeff grew the company to over $50 million in annual revenues with projects ranging from commercial office, senior community centers, and numerous housing types ranging from single customs to large residential subdivisions.

Team

Jeffrey Hinckley

Asset Management

Stacey Holbrook

Property Management

Doyle Barker

Construction Management

Elizabeth Deindoerfer

Administration

Advisors

Bruce Degler

CEO Privately Held Company & Investor

Ben Weiss

Legal Counsel

David Dahl

Investor

William Lindsay

CEO of Financial Planning Company

INVESTMENT PROCESS

01. ORIGINATION

Local market assessment & presence

Competitive property analysis

Trend analysis

Reputation for closing

Strong industry relationships

02. DUE DILLIGENCE

Financial analysis

Extensive 3rd party evaluation

Creation of business plan

03. APPROVAL

IPC approval

Deal & financial structure

Negotiations

Closing

04. EXECUTION

Project management

Construction management

Asset management

Property management

GEOGRAPHIC MARKETS

California has become one of the most expensive cost of living states in the nation and the economic and political environment has been driving both businesses and families out to the surrounding states.

We believe there is a significant opportunity to provide affordable housing options in California as well as take advantage of the population and job inflows experienced by the surrounding states.

PROJECTS

The Retreat

Reno, Nevada

Aquired: 2017

Business Plan: In a Joint Venture to entitle & develop 115 single family lots and 283 apartment homes.

Status: Presold SF lots to public builder, started construction of apartment homes for long-term hold.

City of Sparks Development Site

Sparks, Nevada

Aquired: 2015 "Off Market"

Description: 32 acre "distressed" infill site.

Business Plan: In planning to develop 154 affordable market rate apartment units.

Status: Entitlements in place to start project in 2021.

Mae Anne

Reno, Nevada

Aquired: 2022

Description: 9.3 Acres of land zoned currently for MF-14

Business Plan: Re-entitle and develop land for 59 small lot Single Family Lots

Status: Tentative Map Process Started, Development projected to start Nov. 2021

Highland Village

Sun valley, Nevada

Aquired: 2021

Description: 55.15 acres on East side city next to Spanish Springs. Has approved TM for 216 lots.

Business Plan: Continue to develop site into approved lots. Sell a portion of the lots and retain the ...

Status: Fine tune Tentative map, start development in Nov. 2021

Friars Road

San Diego, California

Aquired: 2013

Description: 3 office buildings, fully leased 5.5 acres "off market and distressed."

Business Plan: Re-entitled for highest & best use, 312 multifamily & 7 live/work units.

Status: SOLD 2017

Marina Village

Sparks, Nevada

Aquired: 2016

Description: 240-unit multifamily rental, 2007 vintage "off market."

Business Plan: Value-add renovation and increased rents, moved NOI to above $1,000,000 in 18 months.

Status: SOLD 2018

The Resort at Tanamera

Reno, Nevada

Aquired: 2016

Description: 103 rented condo units "off market."

Business Plan: Renovate and sell units.

Status: Closed in 2019

Prater – Sparks, Nevada

Sparks, Nevada

Aquired: 2015

Description: The Prater land assemblage totals approximately 20 acres and is an assemblage of 4 sites. LCIP owns one of ...

Business Plan: The Project Business Plan includes multiple uses and is intended to be a mixed-use residential development, ...

Status: SOLD in 2017

Waterfront at Sparks Marina

Sparks, Nevada

Aquired: 2012

Description: 4.25 acres plus parking structure "off market and distressed."

Business Plan: Entitled 2015, 209-unit luxury rental multifamily 5-story wrap / structured parking garage.

Status: Completed and Stabilized, Held For Long Term Investment

Villages of Verona

Corona, California

Aquired: 2011

Description: Distressed 21 acres raw land "off market."

Business Plan: Re-entitle from industrial use to 150 single family lots.

Status: SOLD 2014

Formerly “The Yard”

Sparks, Nevada

Aquired: 2015

Description: 3 Story, 110,000 Square-foot former casino building “off market and distressed”

Business Plan: Entitled 2016 for Mixed Used Retail / Commercial Ground Floor Retail 2nd/3rd Floor Office.

Status: Sold 2017 to become The Sparks Event Center

Square One

Sparks, Nevada

Aquired: 2015

Description: Distressed 6 story, 208-unit hotel redevelopment to 100 apartment units "off market."

Business Plan: Entitled and re-developed 100 rental apartment units, completed 2016.

Status: Held For Long Term Investment

Marina Square

Sparks, Nevada

Aquired: 2013

Description: 2.5 acres improved land, "off-market."

Business Plan: Entitled for a 66-Unit Luxury Apartment Development.

Status: Tentative Construction to Start 2021

Marina Gateway

Sparks, Nevada

Aquired: 2013

Description: Distressed 20 acres of unimproved land, two 10-acre sites "off market."

Business Plan: Entitled in 2014 for a 620-unit multifamily development.

Status: SOLD 2016

Sheldon-Vasari Luxury Apartment Homes

Elk Grove, California

Aquired: 2015

Description: Distressed 20 acres "off market."

Business Plan: Re-entitled from 142 SFR lots to 324 multifamily units, 2-story walk-up.

Status: SOLD 2016

Vida Luxury Apartments

Reno, Nevada

Aquired: 2015

Description: Distressed 20 acres "off market."

Business Plan: Re-entitled from 98 SFR lots to 312 multifamily units two story walk-up.

Status: SOLD 2016

Boardwalk Townhomes

Corona, California

Aquired: 2012

Description: Distressed 8.6 acres raw land "off market.

Business Plan: Entitled in 2016, 148-unit townhome community.

Status: Sale Completed / Sold Our End Of Year 2020

The Marina Town Centre

Sparks, Nevada

Aquired: 2013

Description: Distressed 24,850 square-foot existing mixed-use 3-story building "off market" featuring Sparks Water Bar.

Business Plan: Reposition and re-tenant 100% leased.

Status: Held For Long Term Investment

Third Street Flats

Reno, Nevada

Aquired: 2017

Description: 94-unit multifamily rental plus 10,000 sq. ft mixed-use, 7 story buildings "off market."

Business Plan: Complete commercial rent-up/ stabilization, 1,700 square-feet of vacant ground floor to lease.

Status: Held For Long Term Investment

The Retreat

Reno, Nevada

Aquired: 2017

Description: 32 acre “distressed” infill site.

Business Plan: In a Joint Venture to entitle & develop 115 single family lots and 283 apartment homes.

Status: Presold SF lots to public builder, started construction of apartment homes for long-term hold.

City of Sparks Development Site

Sparks, Nevada

Aquired: 2015 "Off Market"

Description: 32 acre "distressed" infill site.

Business Plan: In planning to develop 154 affordable market rate apartment units.

Status: Entitlements in place to start project in 2021.

Mae Anne

Reno, Nevada

Aquired: 2022

Description: 9.3 Acres of land zoned currently for MF-14

Business Plan: Re-entitle and develop land for 59 small lot Single Family Lots

Status: Tentative Map Process Started, Development projected to start Nov. 2021

Highland Village

Sun valley, Nevada

Aquired: 2021

Description: 55.15 acres on East side city next to Spanish Springs. Has approved TM for 216 lots.

Business Plan: Continue to develop site into approved lots. Sell a portion of the lots and retain the ...

Status: Fine tune Tentative map, start development in Nov. 2021

Friars Road

San Diego, California

Aquired: 2013

Description: 3 office buildings, fully leased 5.5 acres "off market and distressed."

Business Plan: Re-entitled for highest & best use, 312 multifamily & 7 live/work units.

Status: SOLD 2017

Marina Village

Sparks, Nevada

Aquired: 2016

Description: 240-unit multifamily rental, 2007 vintage "off market."

Business Plan: Value-add renovation and increased rents, moved NOI to above $1,000,000 in 18 months.

Status: SOLD 2018

The Resort at Tanamera

Reno, Nevada

Aquired: 2016

Description: 103 rented condo units "off market."

Business Plan: Renovate and sell units.

Status: Closed in 2019

Prater – Sparks, Nevada

Sparks, Nevada

Aquired: 2015

Description: The Prater land assemblage totals approximately 20 acres and is an assemblage of 4 sites. LCIP owns one of ...

Business Plan: The Project Business Plan includes multiple uses and is intended to be a mixed-use residential development, ...

Status: SOLD in 2017

Waterfront at Sparks Marina

Sparks, Nevada

Aquired: 2012

Description: 4.25 acres plus parking structure "off market and distressed."

Business Plan: Entitled 2015, 209-unit luxury rental multifamily 5-story wrap / structured parking garage.

Status: Completed and Stabilized, Held For Long Term Investment

Villages of Verona

Corona, California

Aquired: 2011

Description: Distressed 21 acres raw land "off market."

Business Plan: Re-entitle from industrial use to 150 single family lots.

Status: SOLD 2014

Formerly “The Yard”

Sparks, Nevada

Aquired: 2015

Description: 3 Story, 110,000 Square-foot former casino building “off market and distressed”

Business Plan: Entitled 2016 for Mixed Used Retail / Commercial Ground Floor Retail 2nd/3rd Floor Office.

Status: Sold 2017 to become The Sparks Event Center

Square One

Sparks, Nevada

Aquired: 2015

Description: Distressed 6 story, 208-unit hotel redevelopment to 100 apartment units "off market."

Business Plan: Entitled and re-developed 100 rental apartment units, completed 2016.

Status: Held For Long Term Investment

Marina Square

Sparks, Nevada

Aquired: 2013

Description: 2.5 acres improved land, "off-market."

Business Plan: Entitled for a 66-Unit Luxury Apartment Development.

Status: Tentative Construction to Start 2021

Marina Gateway

Sparks, Nevada

Aquired: 2013

Description: Distressed 20 acres of unimproved land, two 10-acre sites "off market."

Business Plan: Entitled in 2014 for a 620-unit multifamily development.

Status: SOLD 2016

Sheldon-Vasari Luxury Apartment Homes

Elk Grove, California

Aquired: 2015

Description: Distressed 20 acres "off market."

Business Plan: Re-entitled from 142 SFR lots to 324 multifamily units, 2-story walk-up.

Status: SOLD 2016

Vida Luxury Apartments

Reno, Nevada

Aquired: 2015

Description: Distressed 20 acres "off market."

Business Plan: Re-entitled from 98 SFR lots to 312 multifamily units two story walk-up.

Status: SOLD 2016

Boardwalk Townhomes

Corona, California

Aquired: 2012

Description: Distressed 8.6 acres raw land "off market.

Business Plan: Entitled in 2016, 148-unit townhome community.

Status: Sale Completed / Sold Our End Of Year 2020

The Marina Town Centre

Sparks, Nevada

Aquired: 2013

Description: Distressed 24,850 square-foot existing mixed-use 3-story building "off market" featuring Sparks Water Bar.

Business Plan: Reposition and re-tenant 100% leased.

Status: Held For Long Term Investment

Third Street Flats

Reno, Nevada

Aquired: 2017

Description: 94-unit multifamily rental plus 10,000 sq. ft mixed-use, 7 story buildings "off market."

Business Plan: Complete commercial rent-up/ stabilization, 1,700 square-feet of vacant ground floor to lease.

Status: Held For Long Term Investment

The Retreat

Reno, Nevada

Aquired: 2017

Description: 32 acre “distressed” infill site.

Business Plan: In a Joint Venture to entitle & develop 115 single family lots and 283 apartment homes.

Status: Presold SF lots to public builder, started construction of apartment homes for long-term hold.

City of Sparks Development Site

Sparks, Nevada

Aquired: 2015 "Off Market"

Description: 32 acre "distressed" infill site.

Business Plan: In planning to develop 154 affordable market rate apartment units.

Status: Entitlements in place to start project in 2021.

Mae Anne

Reno, Nevada

Aquired: 2022

Description: 9.3 Acres of land zoned currently for MF-14

Business Plan: Re-entitle and develop land for 59 small lot Single Family Lots

Status: Tentative Map Process Started, Development projected to start Nov. 2021

Highland Village

Sun valley, Nevada

Aquired: 2021

Description: 55.15 acres on East side city next to Spanish Springs. Has approved TM for 216 lots.

Business Plan: Continue to develop site into approved lots. Sell a portion of the lots and retain the ...

Status: Fine tune Tentative map, start development in Nov. 2021

CONTACT

LANDCAP INVESTMENT PARTNERS

CORPORATE HEADQUARTERS

Orange County CA

31103 Rancho Viejo Road, Suite D3099

San Juan Capistrano, CA 92675

CALIFORNIA REGIONAL OFFICE

Carlsbad CA

5055 Avenida Encinas, Suite 100

Carlsbad, CA 92008

NEVADA REGIONAL OFFICE

Reno / Sparks NV

325 Harbour Cove, Suite 219

Sparks, NV 89434

"*" indicates required fields